Regular Savings

We all have goals for the future, but these normally have costs associated with them. Regular saving is a way to help you achieve these goals with disciplined savings and smart investing on a monthly, quarterly, semi-annually or annual basis.

Dollar-Cost Averaging

One of the main advantages of regular savings is dollar-cost averaging. Dollar-cost averaging is an investment strategy that involves regular purchases of funds over a period of time, regardless of the share’s price. When the unit price goes down, more shares are bought. When the price goes up, fewer shares will be bought. The effect of dollar-cost averaging is to reduce the impact of volatility on the overall purchase.

- Are you the sole breadwinner for your family?

- Do you have children?

- Do you have any other dependents such as siblings or parents?

- Do you have any outstanding liabilities, such as mortgages or Inheritance Tax?

- Have you estimated your future expenses, such as investments, education or relocation costs?

- What is your current lifestyle?

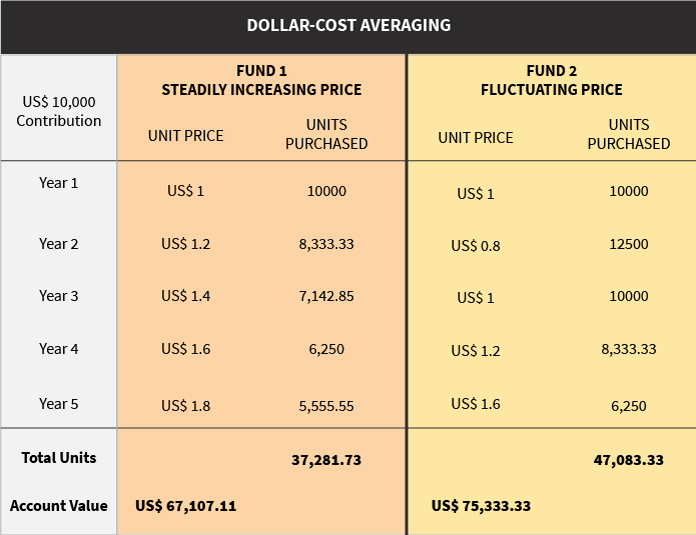

The table below explains how dollar-cost averaging works, comparing two funds: A steadily increasing fund, and one with a fluctuating price.

At first glance, Fund 1, which increased in value 80% over the period, seems better. But in fact, the total number of units bought was stable and stood at 37,282. On the other hand, although Fund 2 only manages to recover its original price after the 3rd year, the investor benefits from purchasing more units for his investment when they were at a lower price, leaving him with a total of 75,333 units.

In both cases, you would make significant returns with a US$10,000 annual investment. However, dollar-cost averaging can be a good strategy when investing in volatile markets.

Protect Your Savings

In case of a sudden illness or accident, you don’t have to utilise your savings to pay the high price for medical treatment. Surgery and room costs in Hong Kong’s private hospitals can easily reach US$100,000 for major heart disease and cancer. This can be covered by the insurance plan, should you have coverage in place. Your savings should be used for their intended use, such as buying a home, funding your children’s education and retirement.

How can Platinum Financial Services help?

As much as all investments carry risks, most can also be mitigated. The team at Platinum will carefully assess your risk profile to ensure that the risks with your investment match your investment and savings objectives. More risk doesn’t always mean more rewards, but with a carefully constructed plan, you can ensure that your money is working as hard for you as you worked hard to earn it.

The cost of quality healthcare is at a premium. We have close partnerships with market-leading international healthcare insurance companies that offer sustainable products making sure that we can match the required level of cover to your budget.

We don’t charge you for our services, so premiums are the same as going directly to the insurance company. What you get is advice on the plan’s benefits and coverage limits that make sense to you and your financial situation.

Don’t leave your financial future to chance.

Contact Platinum Financial Services to help you through your financial journey.

ANDREW CASE STUDY

ANDREW CASE STUDY